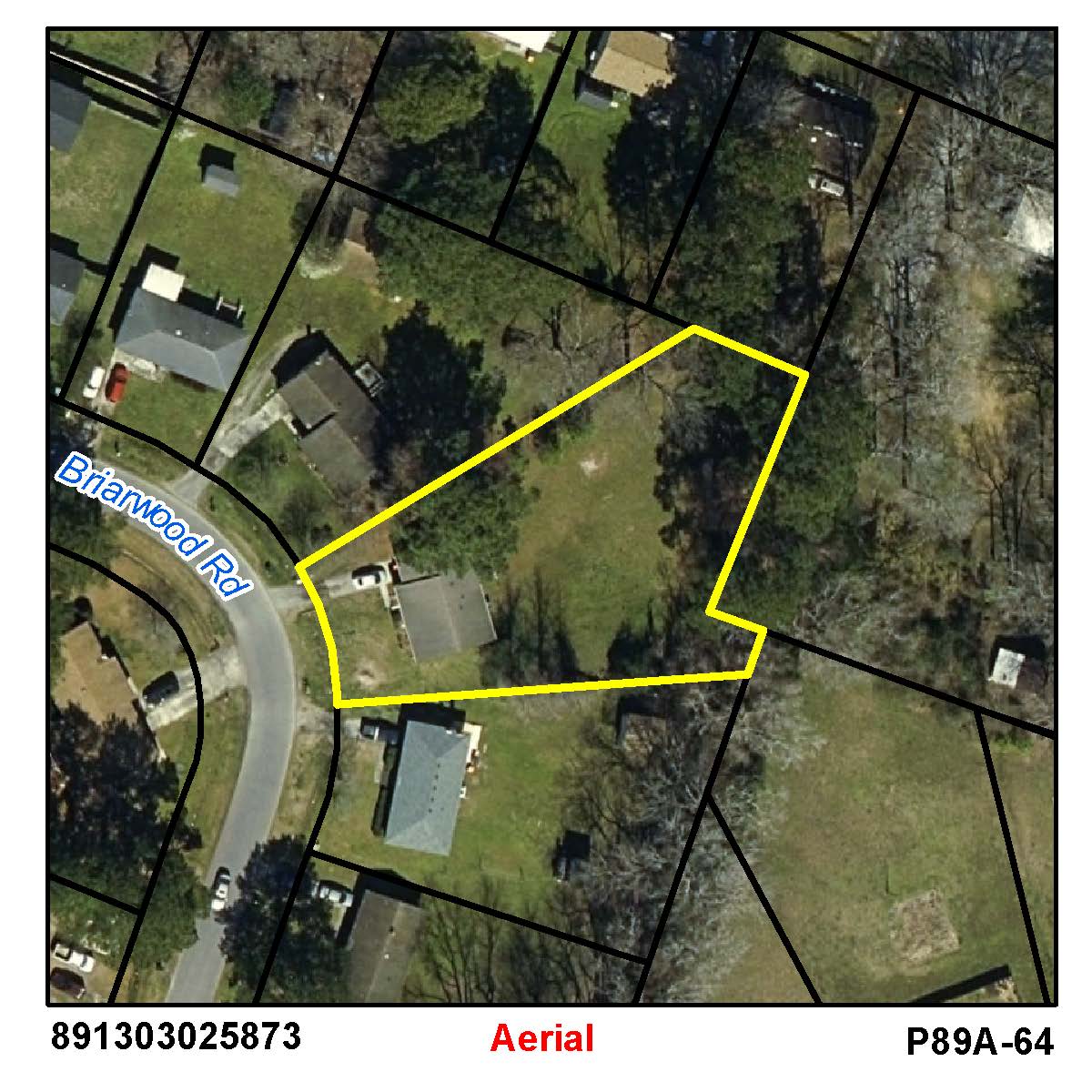

Location: 00712 BRIARWOOD RD

Prior

Evaluation Year: 2014

Current

Evaluation Year: 2022

HOLLIMAN, MICHAEL R & BRITTANY

712 BRIARWOOD RD

ELIZABETH CITY, NC 27909

Acct: 137593

Previous County Tax (.0077): $879.34

New county rate (.0062) (for 2022): $908.92

Estimated City Tax (.0074): $845.08

New city rate (.0059) (for 2022): $864.94

Storm Water Fee: $36

Solid Waste Fee: $144 ($75 for Elderly/Disabled with Exclusion)

$19100

$19100

$0

$0

$95100

$127500

$114200

$146600

$114200

$146600

20231215