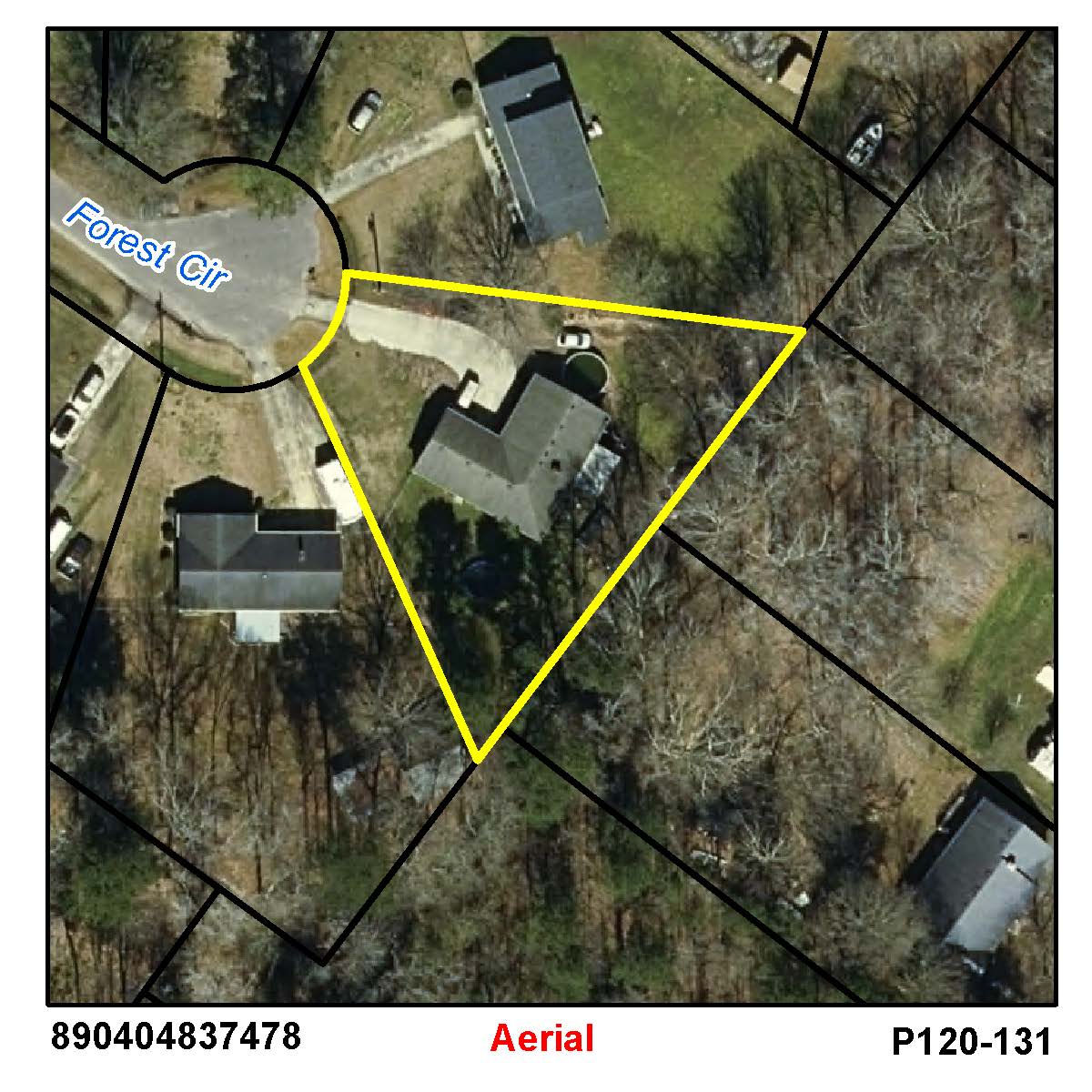

Location: 02101 FOREST CIR

Prior

Evaluation Year: 2014

Current

Evaluation Year: 2022

HICKMAN, AARON L SR

2101 FOREST CIR

ELIZABETH CITY, NC 27909

Acct: 119818

Previous County Tax (.0077): $1087.24

New county rate (.0062) (for 2022): $1290.84

Solid Waste Fee: $144 ($75 for Elderly/Disabled with Exclusion)

$24300

$32900

$0

$0

$116900

$175300

$141200

$208200

$141200

$208200

NEW WINDOWS INSTALLED

20220104