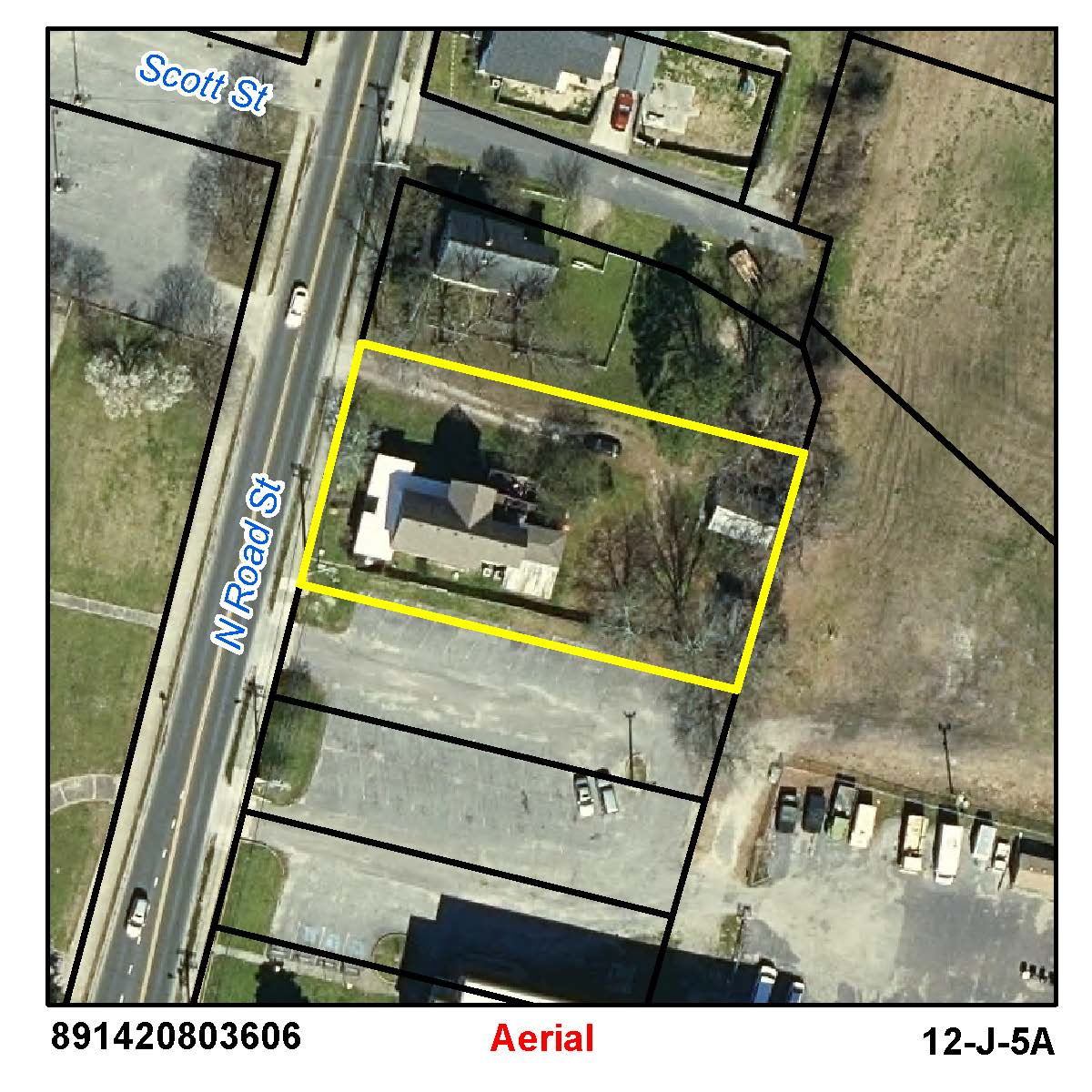

Location: 00314 N ROAD ST

Prior

Evaluation Year: 2014

Current

Evaluation Year: 2022

SLAYTON, GERALD M GEORGIA M

314 N ROAD ST

ELIZABETH CITY, NC 27909

Acct: 133990

Previous County Tax (.0077): $1114.96

New county rate (.0062) (for 2022): $1292.7

Estimated City Tax (.0074): $1071.52

New city rate (.0059) (for 2022): $1230.15

Storm Water Fee: $36

Solid Waste Fee: $144 ($75 for Elderly/Disabled with Exclusion)

$42900

$42900

$0

$0

$101900

$165600

$144800

$208500

$144800

$208500

20220107