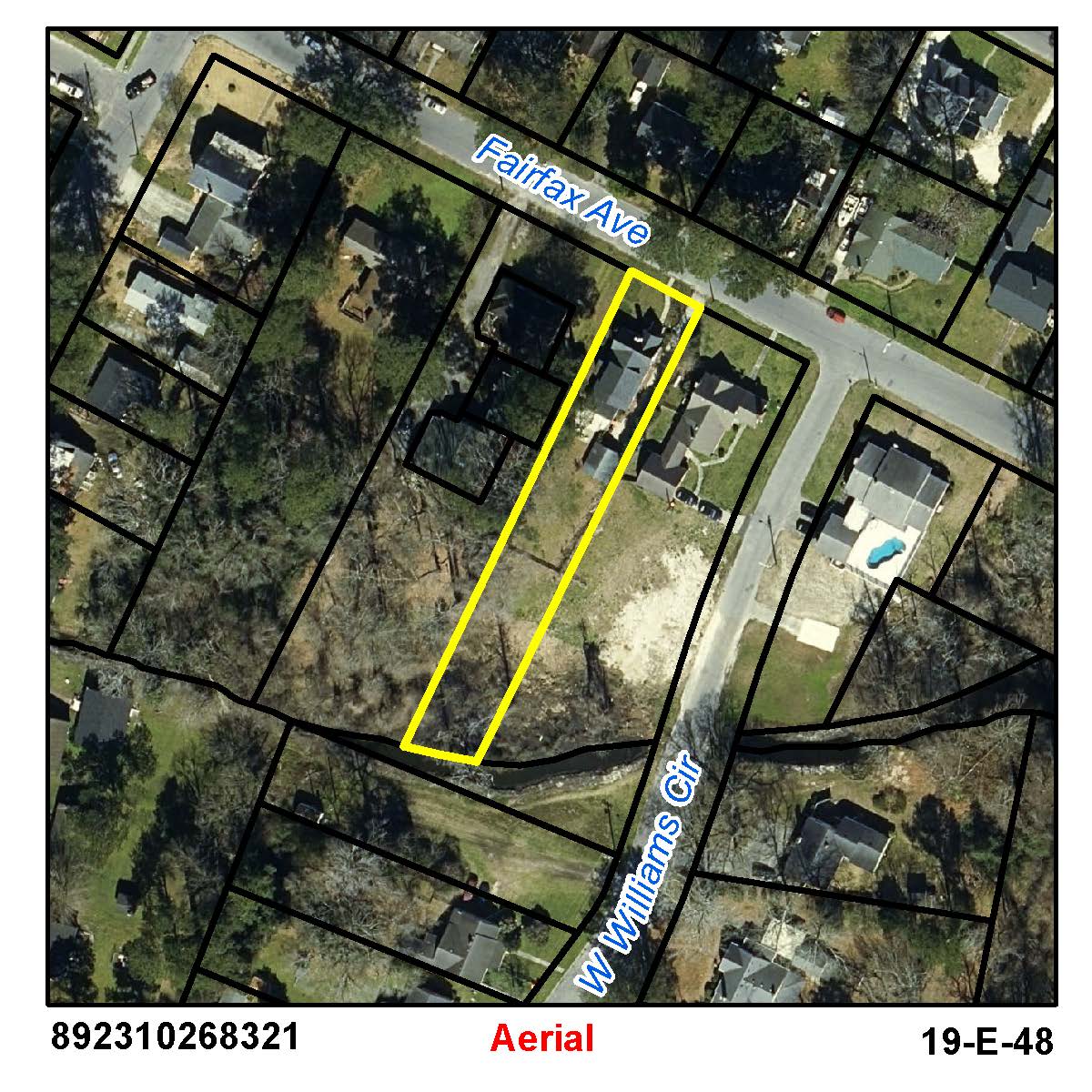

Location: 01209 FAIRFAX AVE

Prior

Evaluation Year: 2014

Current

Evaluation Year: 2022

HATZOPOULOS, SYDMA ELIZABETH

1209 FAIRFAX AVE

ELIZABETH CITY, NC 27909

Acct: 136265

Previous County Tax (.0077): $970.97

New county rate (.0062) (for 2022): $934.96

Estimated City Tax (.0074): $933.14

New city rate (.0059) (for 2022): $889.72

Storm Water Fee: $36

Solid Waste Fee: $144 ($75 for Elderly/Disabled with Exclusion)

$23300

$25600

$0

$0

$102800

$125200

$126100

$150800

$126100

$150800

20230122