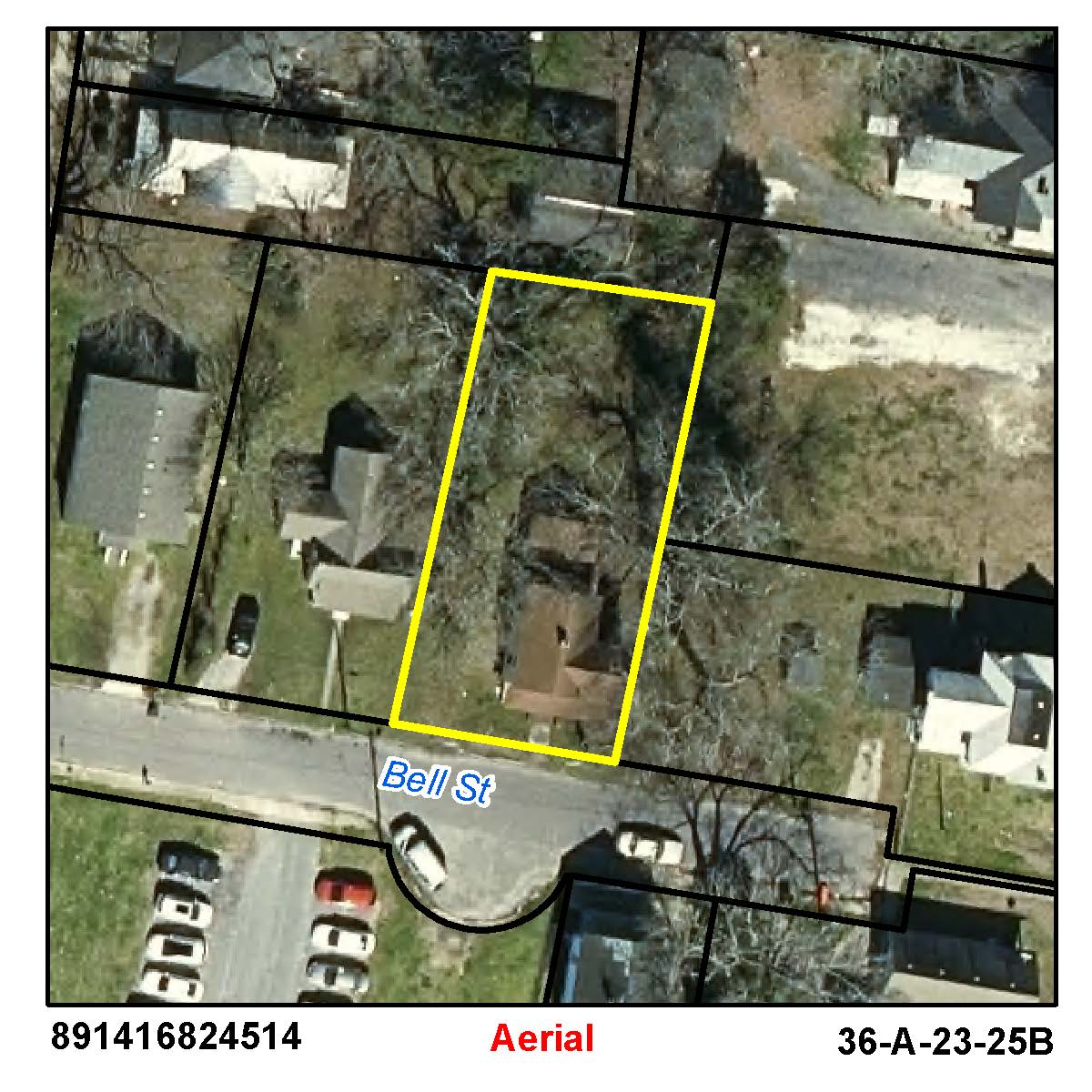

Location: 00104 BELL ST

Prior

Evaluation Year: 2014

Current

Evaluation Year: 2022

CITY OF ELIZ CITY C/O MONTRE' FREEMAN

306 E COLONIAL AVE

ELIZABETH CITY, NC 27909

Acct: 121847

Previous County Tax (.0077): $305.69

New county rate (.0062) (for 2022): $433.38

Estimated City Tax (.0074): $293.78

New city rate (.0059) (for 2022): $412.41

Solid Waste Fee: $144 ($75 for Elderly/Disabled with Exclusion)

$8300

$9500

$0

$0

$31400

$60400

$39700

$69900

$39700

$69900

20240322