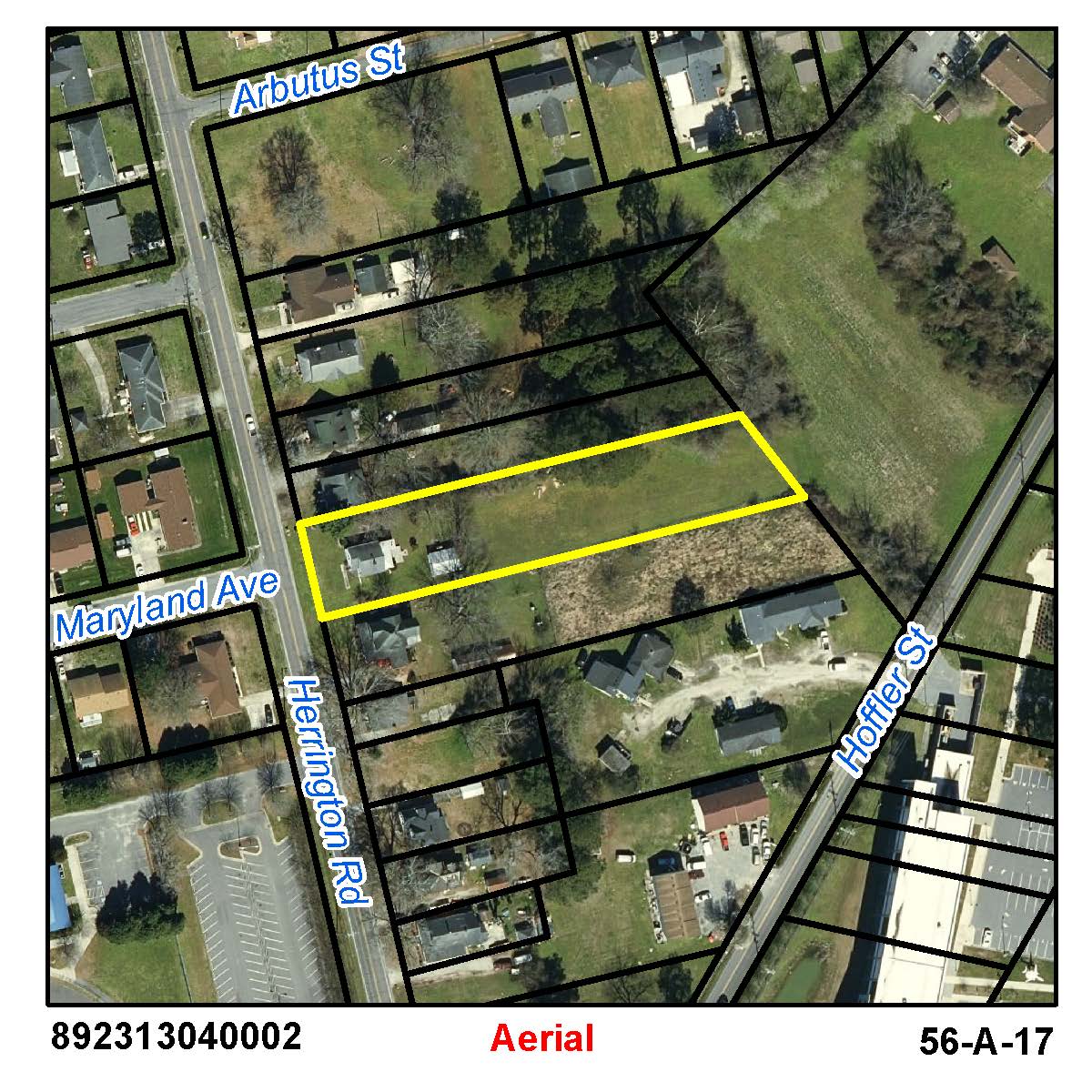

Location: 01500 HERRINGTON RD

Prior

Evaluation Year: 2014

Current

Evaluation Year: 2022

WILSON, LOGAN T

1500 HERRINGTON RD

ELIZABETH CITY, NC 27909

Acct: 146081

Previous County Tax (.0077): $602.14

New county rate (.0062) (for 2022): $444.54

Estimated City Tax (.0074): $578.68

New city rate (.0059) (for 2022): $423.03

Storm Water Fee: $36

Solid Waste Fee: $144 ($75 for Elderly/Disabled with Exclusion)

$45900

$36800

$0

$0

$32300

$34900

$78200

$71700

$78200

$71700

ADJ LAND FOR SHAPE

20250408