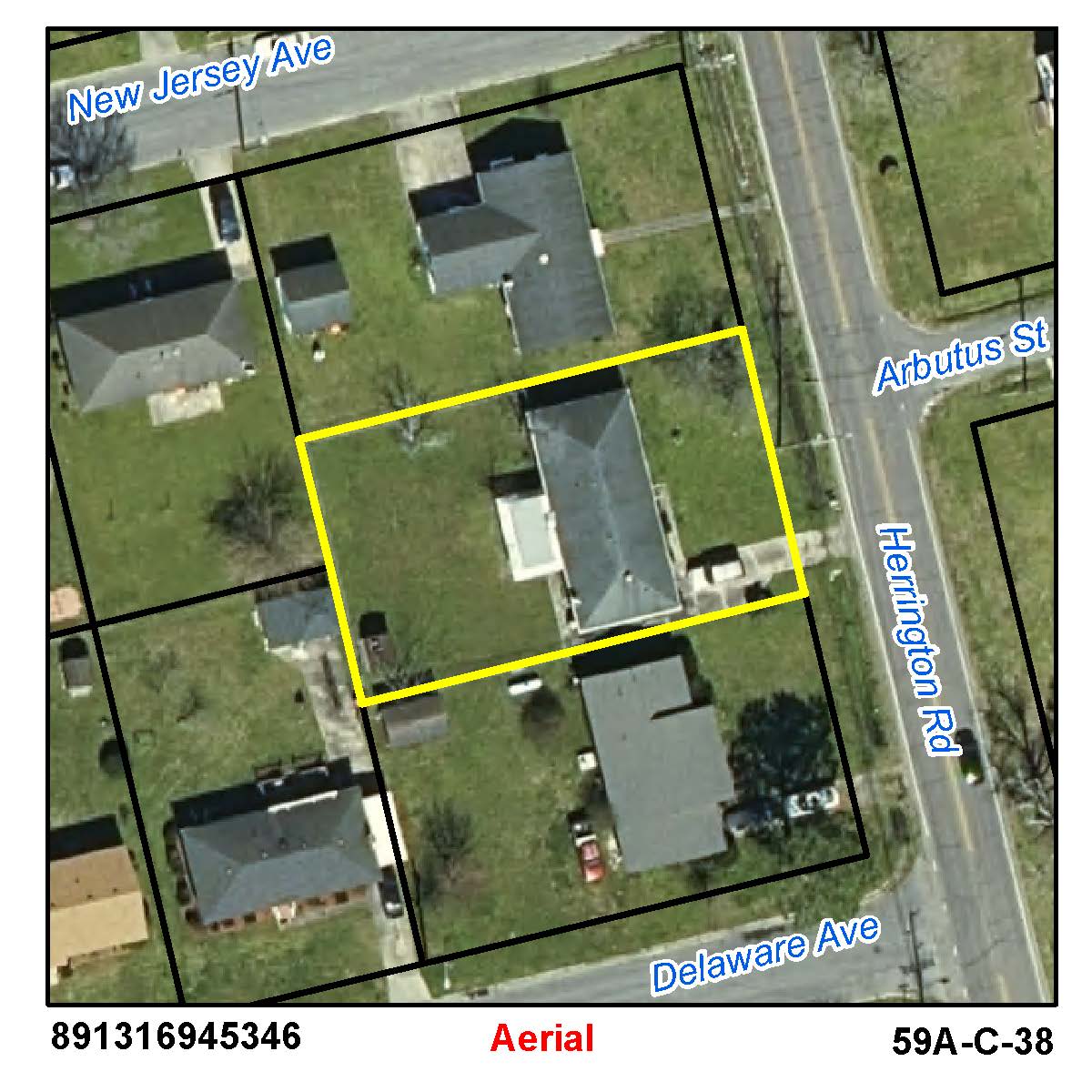

Location: 01403 HERRINGTON RD

Prior

Evaluation Year: 2014

Current

Evaluation Year: 2022

LARABEE HOMES LLC

122 BEECHWOOD RD

AHOSKIE, NC 27910

Acct: 132659

Previous County Tax (.0077): $701.47

New county rate (.0062) (for 2022): $827.7

Estimated City Tax (.0074): $674.14

New city rate (.0059) (for 2022): $787.65

Storm Water Fee: $36

Solid Waste Fee: $144 ($75 for Elderly/Disabled with Exclusion)

$17700

$17700

$0

$0

$73400

$115800

$91100

$133500

$91100

$133500

20240215