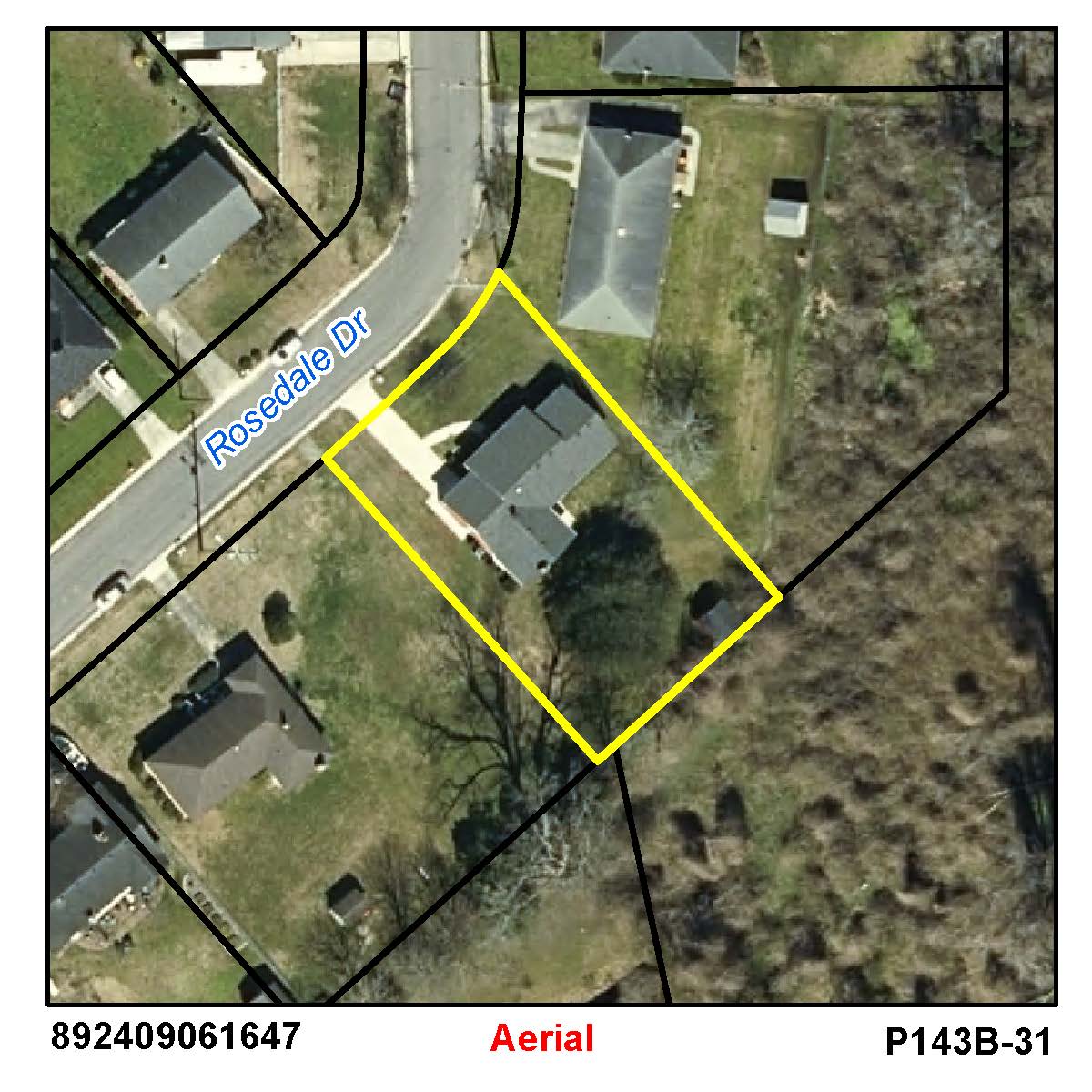

Location: 00117 ROSEDALE DR

Prior

Evaluation Year: 2014

Current

Evaluation Year: 2022

WHITE, STACEY B BATEMAN, MATTHEW

529 S HUGHES BLVD

ELIZABETH CITY, NC 27909

Acct: 136334

Previous County Tax (.0077): $856.24

New county rate (.0062) (for 2022): $973.4

Estimated City Tax (.0074): $822.88

New city rate (.0059) (for 2022): $926.3

Storm Water Fee: $36

Solid Waste Fee: $144 ($75 for Elderly/Disabled with Exclusion)

$37100

$37100

$0

$0

$74100

$119900

$111200

$157000

$111200

$157000

20230124