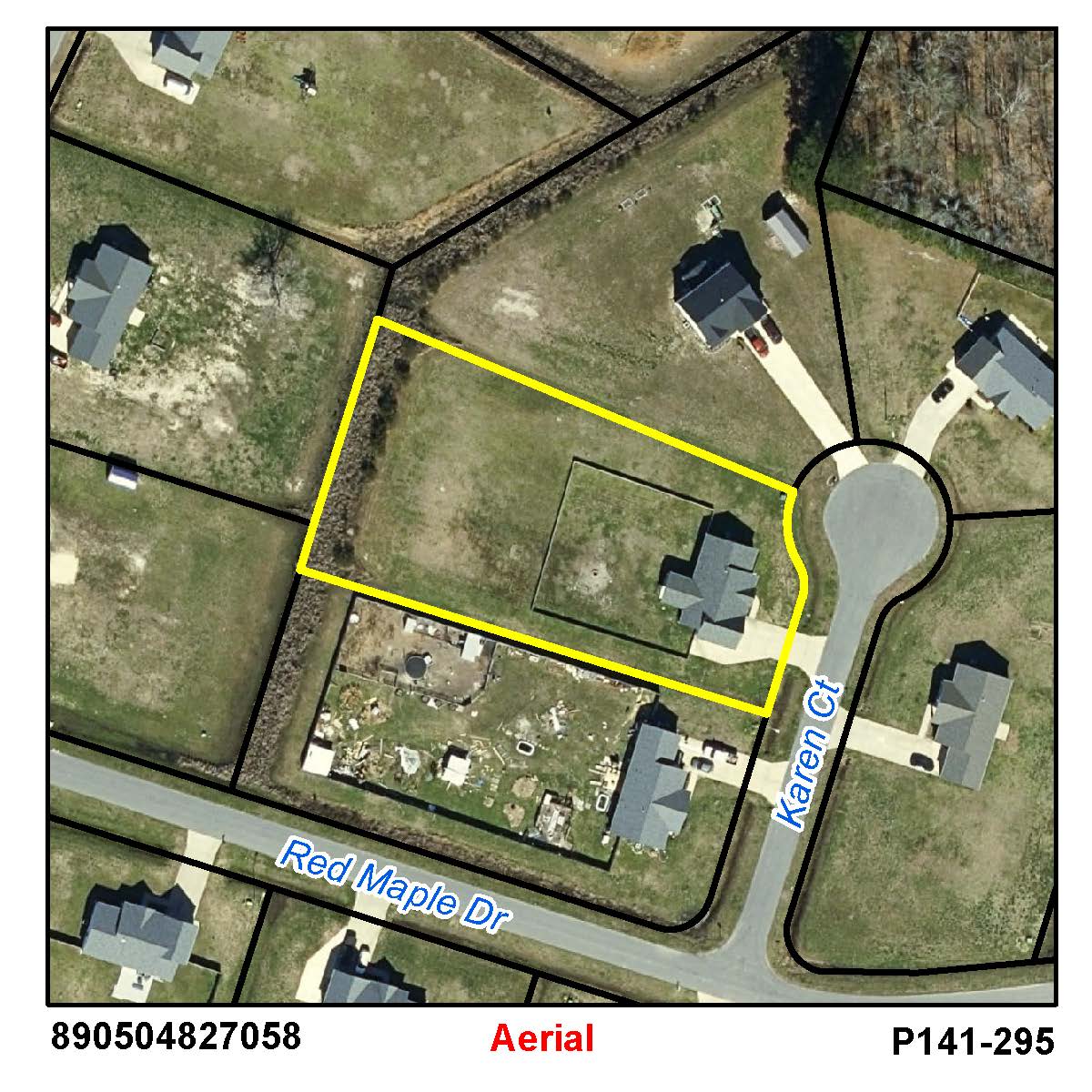

Location: 00103 KAREN CT

Prior

Evaluation Year: 2014

Current

Evaluation Year: 2022

ANDERSON, THOMAS & KELSEY HAGAN

103 KAREN CT

ELIZABETH CITY, NC 27909

Acct: 131897

Previous County Tax (.0077): $1583.12

New county rate (.0062) (for 2022): $1543.8

Solid Waste Fee: $144 ($75 for Elderly/Disabled with Exclusion)

$48200

$48200

$0

$0

$157400

$200800

$205600

$249000

$205600

$249000

20220108